Financial Services That Power Your Fintech Growth

At EStreet, we specialize in end-to-end financial compliance services, helping fintech startups, NBFCs, and financial institutions navigate the regulatory landscape effortlessly while enabling smooth customer onboarding and secure transactions.

End-to-End AML/KYC Services

Accelerate your customer onboarding with seamless, compliant KYC and AML services:

Manual and eKYC Processing

EStreet uses Aadhaar-based e-KYC and video KYC for fast, RBI-compliant digital onboarding processes.

Digital KYC

EStreet leverages RBI-approved digital KYC methods, including e-KYC using Aadhaar authentication and video KYC, ensuring compliant, faster onboarding.

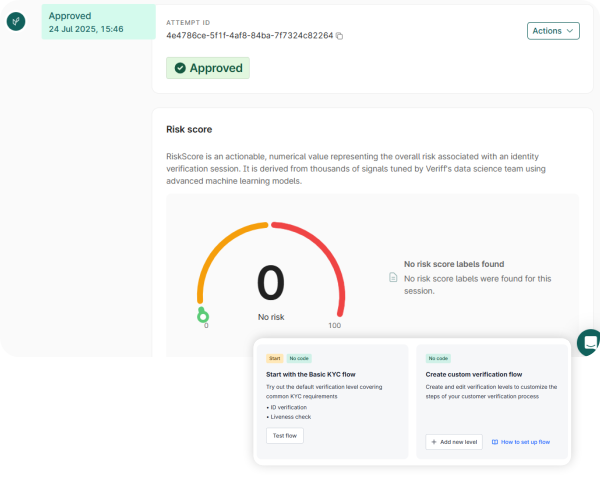

Technology-Driven Tools

We deploy Veriff, Onfido, Sumsub, and KYC Admin to streamline identity verification and reduce drop-offs.

CDD, CIP, and EDD

We conduct CDD, CIP, and EDD checks aligned with PMLA and global AML regulations.

Sanctions Screening

Our specialists run real-time checks on sanctions, PEPs, and negative media to mitigate risks.

Ongoing KYC Updatio

What Sets Us Apart From The Rest?

Expert Compliance Support

For rapidly scaling fintechs, regulatory compliance can get overwhelming. EStreet streamlines it by continuously tracking RBI, SEBI, and PMLA updates, interpreting new directives, and drafting robust AML, KYC, and risk policies. Our routine compliance health checks ensure you’re always prepared for inspections, audits, and regulatory shifts—without disruptions.

Risk & Audit Preparedness

Compliance is ongoing—not a one-time task. EStreet ensures readiness with quarterly audits, internal risk evaluations, and control checks. We support pre-audit planning and full-scale audit management. Fintechs trust us to handle large-scale eKYC operations with compliance assurance, reducing risks and ensuring consistent onboarding without regulatory hiccups.

Smart Transaction Monitoring

We build agile monitoring systems that flag risks without affecting genuine user experiences. EStreet designs risk-based rules, investigates alerts, and supports SAR reporting. Our adaptable frameworks evolve with your business model—protecting operations while ensuring transactions stay smooth, secure, and fully compliant with industry and legal standards.

Your Compliance, Simplified.

At EStreet, we go beyond KYC—building a robust compliance foundation that enables fast onboarding, transparent transactions, regulatory readiness, and trust from both investors and regulators.

Frequently Asked Questions

It covers KYC/AML onboarding, transaction monitoring, sanctions screening, fraud detection, reporting, and audit trails—automated and integrated to ensure full regulatory compliance across all processes.

Yes. Modern compliance solutions offer API-based, low-code integration to seamlessly embed into fintech stacks without disrupting customer experience or existing workflows.

It uses behavior analytics and rule-based engines to scan transactions live, flag anomalies, and reduce fraud or AML breaches before completion.

It includes identity verification, document capture, biometric checks, PEP/sanction screening, and automated risk profiling—ensuring compliant and quick customer onboarding.

Yes. The system detects suspicious patterns, auto-generates SARs, and submits them to regulators in required formats—reducing manual effort and error risk.

Compliance Made Scalable with EStreet

Contact us to streamline AML, KYC, and compliance—empowering your Fintech to scale seamlessly and confidently.